Investing in Property for the first time: The 5 Steps You Need to Succeed Before You Buy

Are you considering diving into the world of property investment? It can be an exciting but daunting journey. To help you navigate through this profitable venture, here are five essential steps you need to take to ensure success in your property investment endeavours.

1. Check You’re in a Position to be Investing in Property

Before embarking on your property investment journey, it’s crucial to assess your financial situation. Evaluate your current financial standing, credit score, and debt levels. Ensure you have a stable income and emergency savings in place. Property investment requires a significant financial commitment, so it’s essential to confirm you’re in a position to take on this responsibility.

2. Be Clear on What Kind of Property Rental You Want and Where to Invest

Decide what type of property rental aligns with your investment goals. Are you interested in family residential properties or perhaps an HMO (House of Multiple Occupancy)? Understanding the rental market and demand in your chosen location will help you make an informed decision on the type of property that suits your investment strategy. Deciding where to invest is a critical step in property investment. Research potential property markets, analyse market trends, evaluate property prices, rental yields, and growth potential. Consider factors like economic stability, population growth, infrastructure development, and rental demand in the area. Choosing the right location can significantly impact the success of your investment and generate lucrative returns in the long run.

3. Get Clear on Your Strategy

Develop a clear investment strategy tailored to your goals. Determine whether you aim for long-term capital appreciation, rental income, or a combination of both. Your strategy will influence the type of properties you invest in, the locations you target, and the financing options you choose. Having a well-defined strategy will steer you in the right direction and guide your decision-making process.

4. Get Financial Advice

Photo by Pixabay

Seeking advice from financial experts or property investment professionals can provide valuable insights into the market, financing options, and investment strategies. A financial advisor can help you assess the risks involved and their expertise can be instrumental in shaping your property investment journey and ensuring financial success.

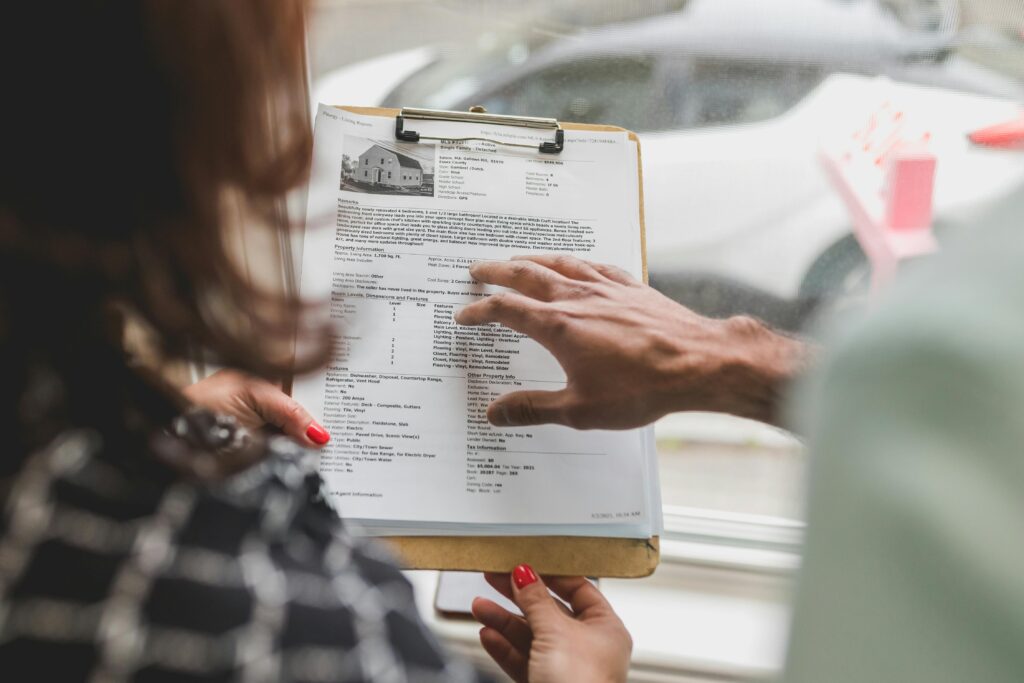

5. Get Property Investment Advice

Photo by RDNE Stock projectPhoto by Pixabay: https://www.pexels.com/photo/gray-and-black-laptop-computer-265087/

When you are embarking on your investment property journey for the first time, you will need some piece of mind that the financial risk you are taking is worth while. It’s essential to .get the best advice possible. Learn from the professionals and talk to a property management team. They can advise on everything from what property to buy, what safety checks you need to make, where to find potential tenants, how to refurbish the property, how to manage the running of the property, what kind of rent to charge and so much more. A good property management agency can even do all of that for you!

Further Reading

Embarking on a property investment journey can be a rewarding experience if approached strategically and diligently. By following these five essential steps, you can set yourself up for success in the competitive world of property investment. Remember, thorough research, careful planning, and sound financial advice are key to thriving in the property market. Good luck on your property investment adventure!

Landlord Advice : The Importance of Location

Investment Property Owners, Did You Know You Could Reclaim Stamp Duty?